AARP Hearing Center

Peach State Saves Delayed, Not Defeated

Recently, Senate Bill 226 - Peach State Saves, which provides a path for Georgia employees to save for retirement, stalled in the Senate Retirement Committee. However, AARP Georgia advocates are still seeking ways to address concerns and make adjustments so that the bill proceeds to a Senate and House vote. SB-226, sponsored by Senator Chuck Hufstetler (R-52), was introduced to the Senate on February 21st and assigned to the retirement committee for review.

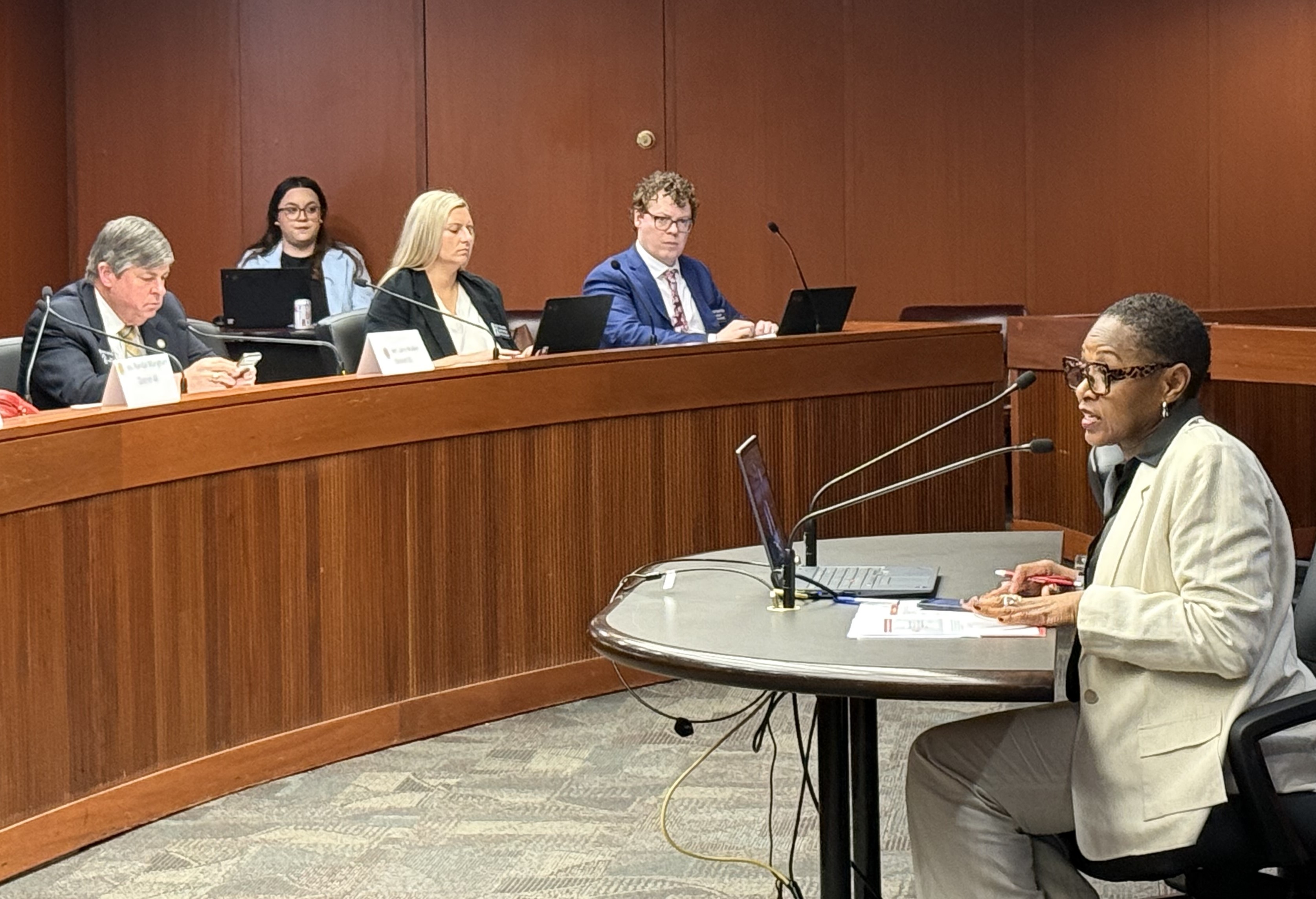

The bill has bi-partisan sponsors; however, during the committee’s initial review on February 27, 2025, the nine-member panel voted down the bill by 5 to 4. Before the vote, committee members expressed concerns about some of the bill’s language saying that it would penalize small business owners who opted out of the employee retirement plan.

“While this is disappointing, it is not the end of our work,” said Alice Bennett, AARP Georgia’s Manager of Advocacy. “The bill is still in committee, and we can present a substitute bill based on feedback. We will continue working with AARP Government Affairs and Employee’s Retirement Services of Georgia to alter the bill and get us to the next step.”

Peach State Saves, co-sponsored by three Democrats and 10 Republicans, will strengthen approximately 2 million Georgia workers’ financial future. According to a recent Pew study, if retirement savings remain at current levels, the lack of household retirement savings will lead to an $8 billion increase in state spending by 2040 due to increased public assistance costs, reduced tax revenue, and decreased household spending. In a recent op-ed, Hufstetler said, “Based on these facts, I am convinced that a retirement savings option would be a great help to our men and women as they age and plan for their retirement while being a great savings to the state as a whole. And once an employee enrolls into the plan, it is portable, so it can transfer from one employer to another.”