AARP Hearing Center

Nebraska Cryptocurrency Scams on the Rise

Fraudsters continue to employ familiar scam tactics—such as romance scams, investment schemes, and government impersonations—but are now increasingly soliciting payments through cryptocurrency kiosks.

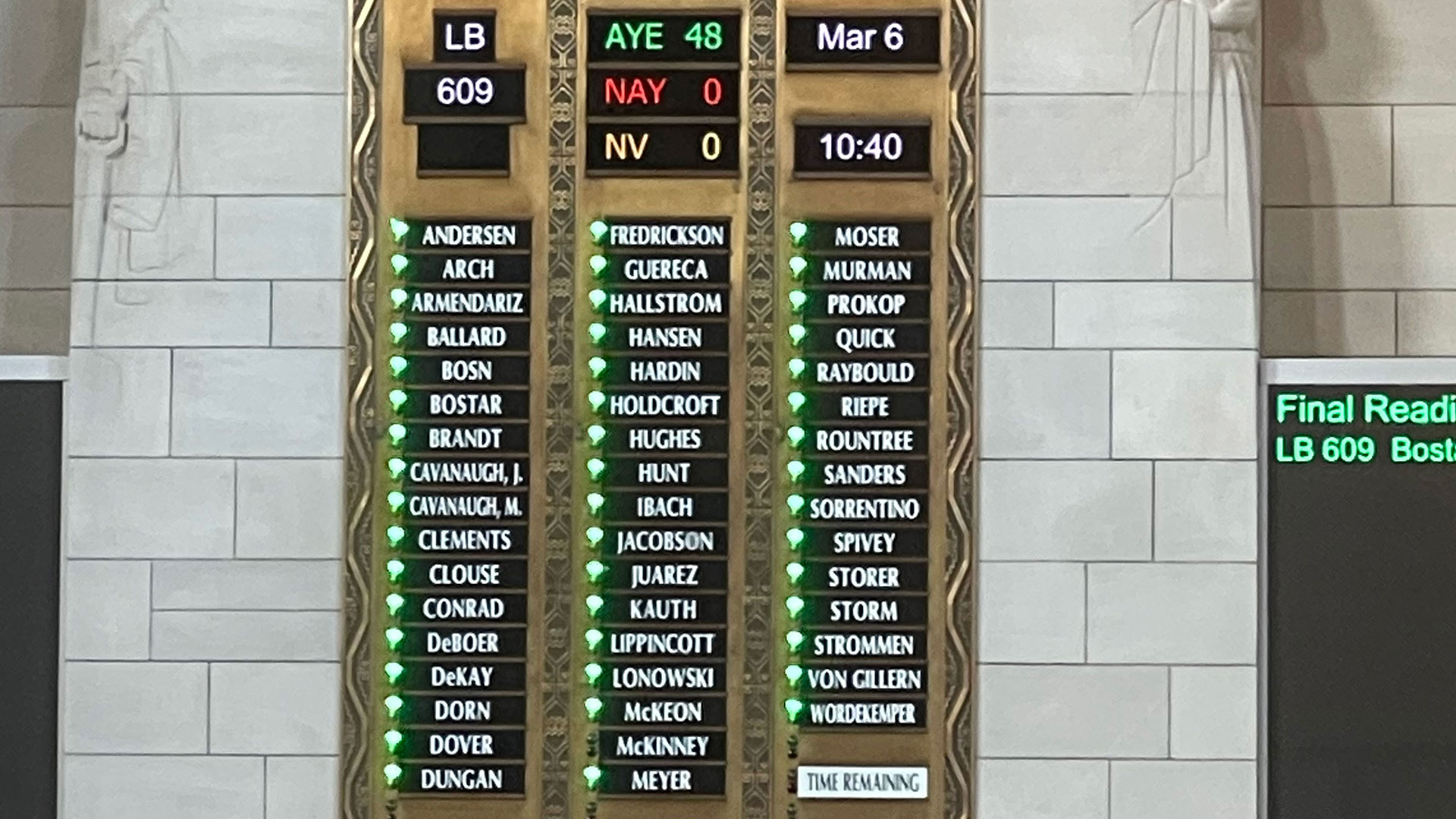

On March 11, Governor Jim Pillen signed Nebraska Legislative Bill 609, the Controllable Electronic Record Fraud Prevention Act, into law. Introduced by State Senator Eliot Bostar and endorsed by AARP Nebraska, the bill successfully passed its final reading on March 6.

This crucial legislation was designed to implement consumer protections from scams involving gift cards and cryptocurrency kiosks—also known as digital currency ATMs. Similar in appearance to a bank ATM, they allow people to conduct cryptocurrency transactions, such as sending money through a digital wallet. Once the money is gone, it's very hard to track and recoup.

Prior to this law, these kiosks have been largely unregulated at the state level compared to traditional financial institutions, lacking sufficient consumer fraud protections. Because of this, criminals have been using them to commit fraud and steal millions of dollars through highly sophisticated scams.

Todd Stubbendieck, State Director of AARP Nebraska, shared “This is a significant victory for Nebraskans and law enforcement. With stronger protections against cryptocurrency theft, we are better equipped to safeguard Nebraskans’ hard-earned life savings, especially for those aged 50 and older, from financial exploitation.”

Cryptocurrency kiosks can be found nearly anywhere that you frequent, such as supermarkets, convenience stores, gas stations, bars, and restaurants. They look like a bank ATM, but they allow people to conduct cryptocurrency transactions, such as sending money through a digital wallet. Once the money is gone, it's very hard to track back and recoup.

Consumer Protections Outlined in LB609:

- Licensing of State Operators: Ensures only vetted operators manage these kiosks.

- Daily Transaction Limits: Protects consumers from large-scale theft.

- Fraud Warning Notices: Increases awareness about potential scams.

- Transaction Receipts: Provides traceability to assist law enforcement with criminal investigations.

- Fee Caps: Prevents excessive charges.

- Refunds: Requires cryptocurrency operators to issue refunds for transactions identified as fraudulent.

In 2023 alone, the FBI received over 5,500 complaints involving cryptocurrency kiosks, with reported losses amounting to over $189 million. Alarmingly, more than 65% of these losses were incurred by individuals aged 60 and above. Overall, the FBI reported $5.6 billion in crypto-fraud losses in the same year.

Nebraskans themselves reported 239 digital currency scam complaints in 2023, totaling approximately $14.6 million in losses. The actual losses are likely higher, as many victims are hesitant to report scams due to embarrassment.

Let's put an end to cryptocurrency kiosk fraud in our Cornhusker state!

Not sure if you've been a victim of fraud? Call 877-908-3360 to speak with a specialist at the AARP Fraud Watch NetworkTM Helpline.

'Grandma Posse' Gets Word Out in Douglas County About Crypto Scams (WOWT First Alert 6, 5/21/25)

Pillen Signs Protections Against Cryptocurrency Fraud into Nebraska Law (Yahoo! News, 3/12/25)

'Grandma Posse' Making Sure Every Bitcoin ATM in Omaha Has Scam Warning Sticker (WOWT First Alert 6, 3/10/25)

Nebraska Legislature Passes Cryptocurrency Regulation Bill (msn.com, 3/7/25)

Nebraska Lawmakers Unite to Pass Cryptocurrency Fraud Prevention Legislation (AARP Nebraska, 3/6/25)

AARP Nebraska Ups Focus on Crypto Currency Scams (Public News Service, 3/6/25)

NE Lawmakers Look at Tougher Regulation of "Crypto Kiosks" (Public News Service, 2/3/25)

Nebraska Legislature to Consider Bill Regulating Cryptocurrency Kiosks (Kiosk Marketplace, 1/31/25)

Nebraska Legislation Targets Cryptocurrency Kiosk Fraud with New Consumer Safeguards (AARP Nebraska, 1/30/25)