Editor's note: A top priority for AARP is ensuring we are protecting those most at risk during the coronavirus pandemic, including our volunteers and taxpayers. Therefore, the AARP Foundation has suspended Tax-Aide services beginning March 16 until further notice. Please visit aarpfoundation.org/taxhelp for the most up-to-date information, including site re-openings.

En español | Doing your own taxes is not the same as removing your own carbuncle, although it may feel like it. But if you need tax help, you can get it — and often at no charge.

Nearly 90 percent of tax filers use software to figure their federal or state income tax, according to the Internal Revenue Service. If you want to buy your own software, you could pay up to $100 or even more for the service, depending on the complexity of your return. (Hint: If you have rental income or limited partnership units, or run a small business, your return will probably be considered complex.)

However, if your adjusted gross income is $69,000 or less — whether you file a joint or single return — you can use tax software to file your 2019 federal return for free, thanks to IRS Free File. (Adjusted gross income is your wages and other income minus adjustments such as educator expenses, student loan interest, alimony payments or contributions to certain retirement accounts.) Free File is a public-private partnership with 10 software companies.

"[Free File] offers free software, free electronic filing and free direct deposit, which is the fastest way to get a refund,” said Ken Corbin, commissioner of the IRS Wage & Investment Division.

The IRS has tightened standards on Free File providers in 2020 to make it easier to find Free File options and to protect filers from unnecessary fees. Keep in mind, though, that there may be additional fees to file state tax returns, as well as to file returns if your AGI exceeds $69,000. But the Free File providers are required to disclose this prominently.

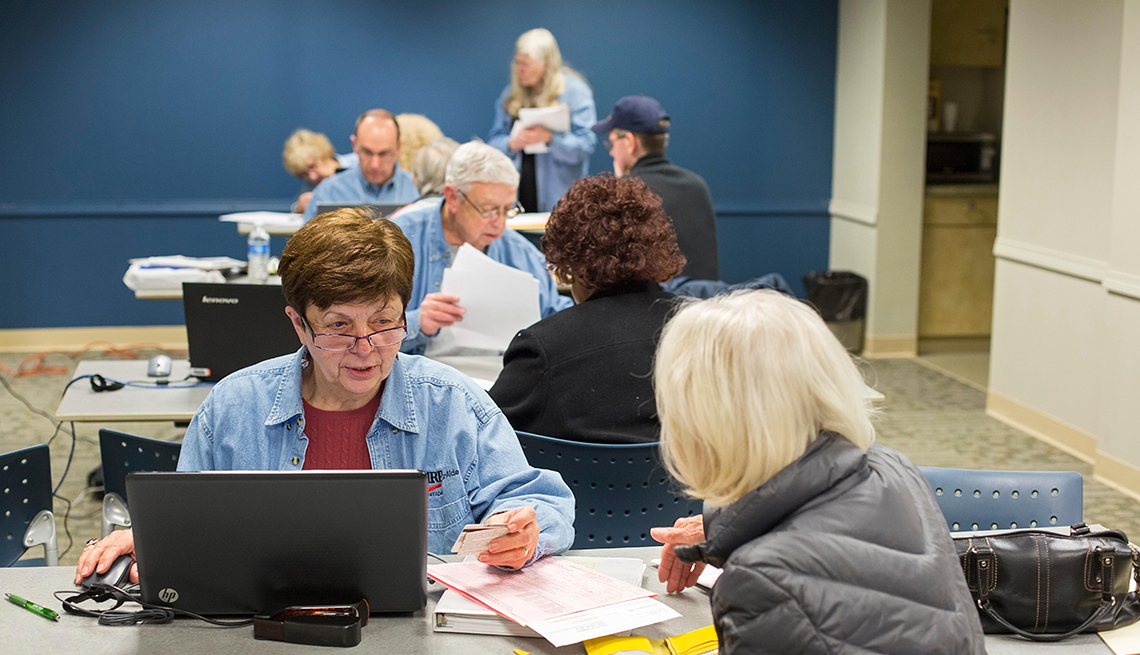

AARP Foundation Tax-Aide offers free tax prep across the U.S.

For filers who prefer a helping hand from a human, there's the AARP Foundation Tax-Aide program, with nearly 5,000 locations nationwide.

"All of our tax preparations are done by trained volunteers who must complete training and pass IRS certification annually to assist in tax preparation,” says Lynnette Lee-Villanueva, vice president of AARP Foundation Tax-Aide.

Although anyone can use Tax-Aide — AARP membership isn't required, and there are no age or income restrictions — the program is especially suited to low- to moderate-income taxpayers who are 50 and older. Find out more online or call 888-AARP-NOW (888-227-7669).