AARP Hearing Center

Tennessee: Postal Inspectors in Memphis Take on Fraud

The Memphis post office clerk who called Margaret Greene sounded concerned about a possible scam in progress.

An older customer had just tried to mail two $9,000 checks, the clerk told Greene, a U.S. postal inspector who investigates fraud. Greene tried to convince the customer he was being targeted. But he was sure he’d won $1.5 million in a lottery and needed to pay $33,750 in fees to collect his “winnings.”

A few days later, Greene got another call, this time from an AARP member worried a relative was being scammed. It turned out to be the same man.

“I thought, Oh, my God, this is divine intervention,” she recalls.

Greene learned the man had dementia and had given more than $140,000 to the scammers. She counseled his relatives on how to get legal authority to make decisions on his behalf.

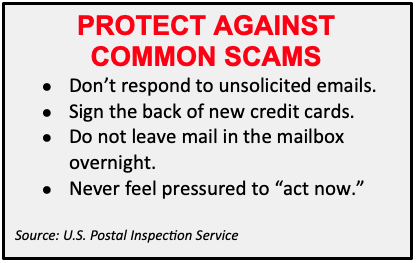

Such sham lotteries are among the common types of fraud that Greene and fellow U.S. postal inspector Susan Link often give talks about, in collaboration with AARP, to help educate Tennesseans about how to spot and avoid scams.

In 2023, the Federal Trade Commission received roughly 86,000 fraud, identity theft and other complaints in Tennessee. Fraud losses totaled $133.6 million over that period, FTC data shows.

‘What do you do?’

U.S. postal inspectors are law enforcement agents who are authorized to carry weapons and make arrests.

They can investigate any crime that uses the U.S. Postal Service—from package theft and suspicious mail to the selling of illegal narcotics, money laundering and cybercrime. More than 1,200 inspectors across the country help enforce roughly 200 federal laws.

Greene and Link acknowledged that many people don’t understand what they do.

“When I tell people I’m a postal inspector, they say, ‘What do you do, inspect stamps?’” says Greene, who admits even she didn’t fully understand the job when she started working in a different division of the postal service 26 years ago.

Then one day she saw a flyer about postal inspectors and their work, and she was inspired to go back and get her bachelor’s degree so she could become one herself.

Link worked as a police officer for 10 years in Lincoln, Nebraska, before joining the Postal Inspection Service. Now, she and Greene both focus on fighting white collar fraud.

On the case

The women have taken on a wide range of investigations over the years.

There was the couple who scammed people by posting items on Facebook Marketplace, a thief who took checks out of more than 400 Memphis mailboxes and a con artist who stole people’s identities by scanning obituaries.

One woman was at the mortuary planning her husband’s funeral when the bank called and told her someone had taken money from their joint account, Link recalled.

“She was beyond upset,” Link says. “She did a lot of work on trying to track down the guy before she called us.”

Greene says she once arrested two suspects who worked at the airport. One drove a baggage truck full of mail, while the other sat in the back, ripping open envelopes.

“I chased them all over the tarmac,” she says.

Lottery or sweepstakes scams are particularly common, Link and Greene note. In those cases, a criminal convinces someone they have won a large sum of money, but that they need to pay taxes before they can get the winnings.

Greene says she once went to the house of a physician who was “1,000 percent adamant” he had been awarded an astronomical amount of money and paid more than $500,000 to get it.

“You think professional people don’t fall for that, but yes, they do,” she says.

Greene notes that legitimate lotteries and sweepstakes contests never require a payment to get the cash prize.

Other common schemes include the imposter scam, in which a criminal pretends to be a family member asking for money, and the “romance” scam, in which a stranger develops a relationship with the victim before asking for money.

Sometimes, it can be tough to get people to believe they might be a fraud target.

A woman who spent upwards of $800,000 paying “taxes” on supposed winnings had been warned by three different postal inspectors, as well as her financial adviser, Link says.

Many individuals who are ensnared in romance schemes also don’t want to believe it, Links says.

“They’re lonely and these people ... are telling them what they want to hear,” she says. “It’s heartbreaking.”

Building connections

Link and Greene began collaborating with AARP Tennessee in 2020 when both the inspectors and AARP were searching for ways to share information during COVID-19 lockdowns.

Many people were isolated and vulnerable to scammers, says Caprice Morgan, community outreach director for AARP Tennessee’s west division. Telephone town halls with the inspectors gave participants a chance to ask questions and get tips from the comfort of their living rooms, Morgan says.

One of the benefits of working with AARP, Link says, is that the organization is a trusted source of information.

“Even though I have a badge ... and I am just asking them not to spend any more money, they don’t want to believe me,” she says. “But they do believe [AARP].”

Before joining forces with AARP, Link and Greene often did presentations at libraries or assisted living facilities, where they said they might reach 25 or 50 people at most. So they were thrilled to reach a much larger audience through AARP’s in-person events and telephone town halls, which often attract hundreds of members.

“It hits home ... when you have somebody who has that real-life experience and real-life stories,” says Seth Boffeli, a senior fraud advisor for the AARP Fraud Watch Network.

Want to meet the postal inspectors? AARP Tennessee is hosting a free shredding event at 10 a.m. on Saturday, April 27 at the Whitehaven branch of the Memphis Public Library, and Greene and Link will be there. Bring your questions about fraud — and any documents with sensitive personal information that you want destroyed.

Michelle Crouch, a North Carolina-based writer, covers long-term care and other issues. She has written for the Bulletin for more than a decade.

More on Fraud

- How AARP Is Fighting Scammers Across the Country

- Scammers Use AI to Include Images of 'Shark Tank' Stars in Bogus Ads

- Record $10 Billion Lost to Scams and Fraud in 2023