Support for family caregivers through the Credit for Caring Act

WASHINGTON, DC -- AARP is urging passage of the bipartisan, bicameral Credit for Caring Act (S. 1670/H.R. 3321) introduced by Senators Ernst, Bennet, Capito, and Warren and Representative Sánchez that would provide a new, non-refundable federal tax credit of up to $5,000 to eligible family caregivers to help address the financial challenges of caring for parents, spouses, and other loved ones while remaining in the workforce. The vast majority of individuals 50-plus (92 percent) support a federal tax credit for family caregivers.

BACKGROUND

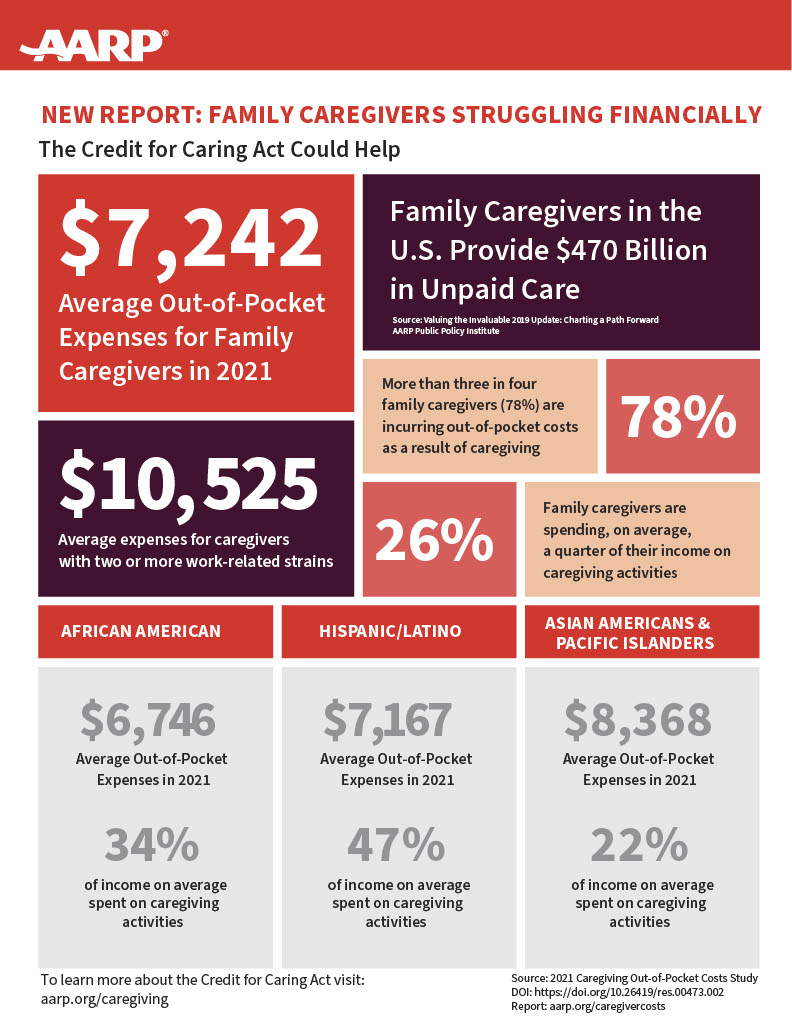

Family caregivers are the backbone of the U.S. care system, helping parents, spouses, and other loved ones live independently in their homes, providing about $470 billion annually in unpaid care. In North Carolina, there are 1.33 million family caregivers who provide over $13 billion dollars in uncompensated care each year.

This care ultimately helps save taxpayer money by delaying or preventing expensive nursing home stays and hospital visits, though often at the cost of caregivers’ own financial security (including out-of-pocket expenses) and physical and emotional health. AARP believes family caregivers have earned support as they take on these costs and responsibilities which have been compounded by the COVID-19 pandemic.

WHY IS THE ACT NEEDED?

Nearly eight in ten family caregivers (78 percent) incur out-of-pocket costs due to caregiving. Caregivers spend on average $7,242 annually on care related expenses, or 26 percent of their income on average, though Hispanic /Latino and African American caregivers reported greater financial strain. These personal contributions will likely to grow in the future. Nearly half of family caregivers (47 percent) experienced at least one financial setback, such as having to dip into their personal savings, cut back on their own health care spending, or reduce how much they save for their retirement. But, if working family caregivers age 50-plus have support, the U.S. GDP could grow by an additional $1.7 trillion in 2030. Too often, employed family caregivers leave the workforce or reduce their hours to fulfill their caregiving duties, which can result in a loss of income, retirement savings, benefits, and career mobility. The COVID-19 pandemic has significantly increased these risks with services family caregivers depend on, such as adult day services, being closed, further shifting the responsibilities to family caregivers.

The Credit for Caring Act would help working family caregivers offset the cost of some caregiving expenses such as a home care aide, adult day services, home modifications, assistive technology, respite care, transportation, or other supports that help them and their loved ones. The bill, unlike the existing child and dependent care credit, would help family caregivers who care for non-dependents or who do not live with the person they are assisting.

HOW WOULD IT WORK?

Eligible family caregivers assisting loved ones of all ages would receive the credit if the care recipient meets certain functional or cognitive limitations or other requirements certified by a licensed health care practitioner. The amount of the credit would be 30 percent of the qualified expenses paid or incurred by the family caregiver above $2,000, up to a maximum credit amount of $5,000. Individuals with higher incomes would be ineligible for the tax credit, and the bill includes provisions to prevent double-dipping with existing tax provisions. How would the Credit for Caring Act work? A federal tax credit for family caregivers has strong support across party lines among individuals 50-plus, with 96 percent of Democrats, 95 percent of Independents, and 87 percent of Republicans supporting it.

HELP SHOW YOUR SUPPORT

Sign up for AARP Action Alerts and help us improve the health and financial security of older adults in North Carolina and across the nation.